- STUDENT LIFE

- …

- STUDENT LIFE

- STUDENT LIFE

- …

- STUDENT LIFE

MEDICAL INSURANCE

Health Insurance

For EU students:

European Health Insurance Card (EHIC): If you're from an EU/EEA country or Switzerland, you should get an EHIC from your home country before leaving. This card will cover you for general healthcare during your studies.

For non-EU students:

- Most non-EU students are required to register for French social security (Sécurité Sociale) upon arrival in France.

Upon arrival, register on the dedicated website (etudiant-etranger.ameli.fr) with your passport, proof of enrollment in a French educational institution, and proof of residence in France. Documents Required: Passport, student visa or residence permit, birth certificate, proof of enrollment, proof of residence, and bank details (RIB).

Carte Vitale: After processing, you will receive a temporary social security number and later a permanent one, along with a Carte Vitale, which you can use to access healthcare services.

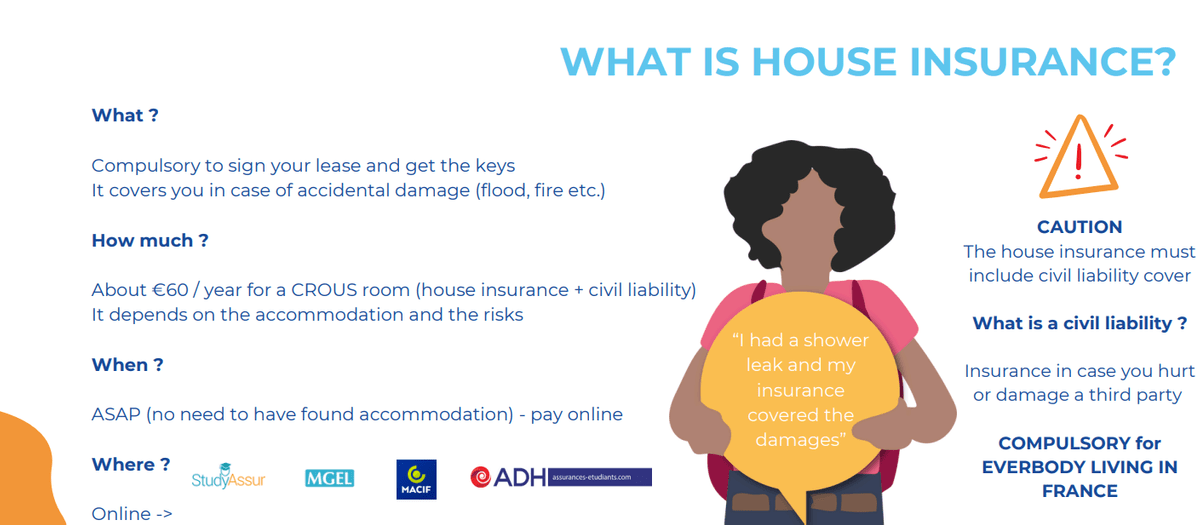

Housing Insurance

If you rent accommodation in France, you must have housing insurance, which covers risks like fire, water damage, and theft.

- Rental Agencies/Banks: Often, rental agencies or banks will offer housing insurance packages for students.

- Independent Insurance Companies: You can also purchase housing insurance from companies

Liability insurance (assurance de responsabilité civile)

This insurance covers you in case you cause damage to others or their property.

-Student insurance providers

-Bank packages: some French banks provide insurance packages that include liability insurance when you open a student account.

Bank account

1. Chose a bank

2. Gather necessary documents: passport or national ID, student visa or residence permit, proof of enrollment, proof of address, proof of income or financial support.

3. Visit a branch or apply online

4. Receive your bank details and debit card

There are alternatives to those traditional bank accounts:

1. Online banks and neobanks (they have more flexible requirements and are easier to set up)

2. Prepaid cards

3. Money transfer services (permit you to receive money without a bank account)

© 2024